By lmoser, 20. April 2020

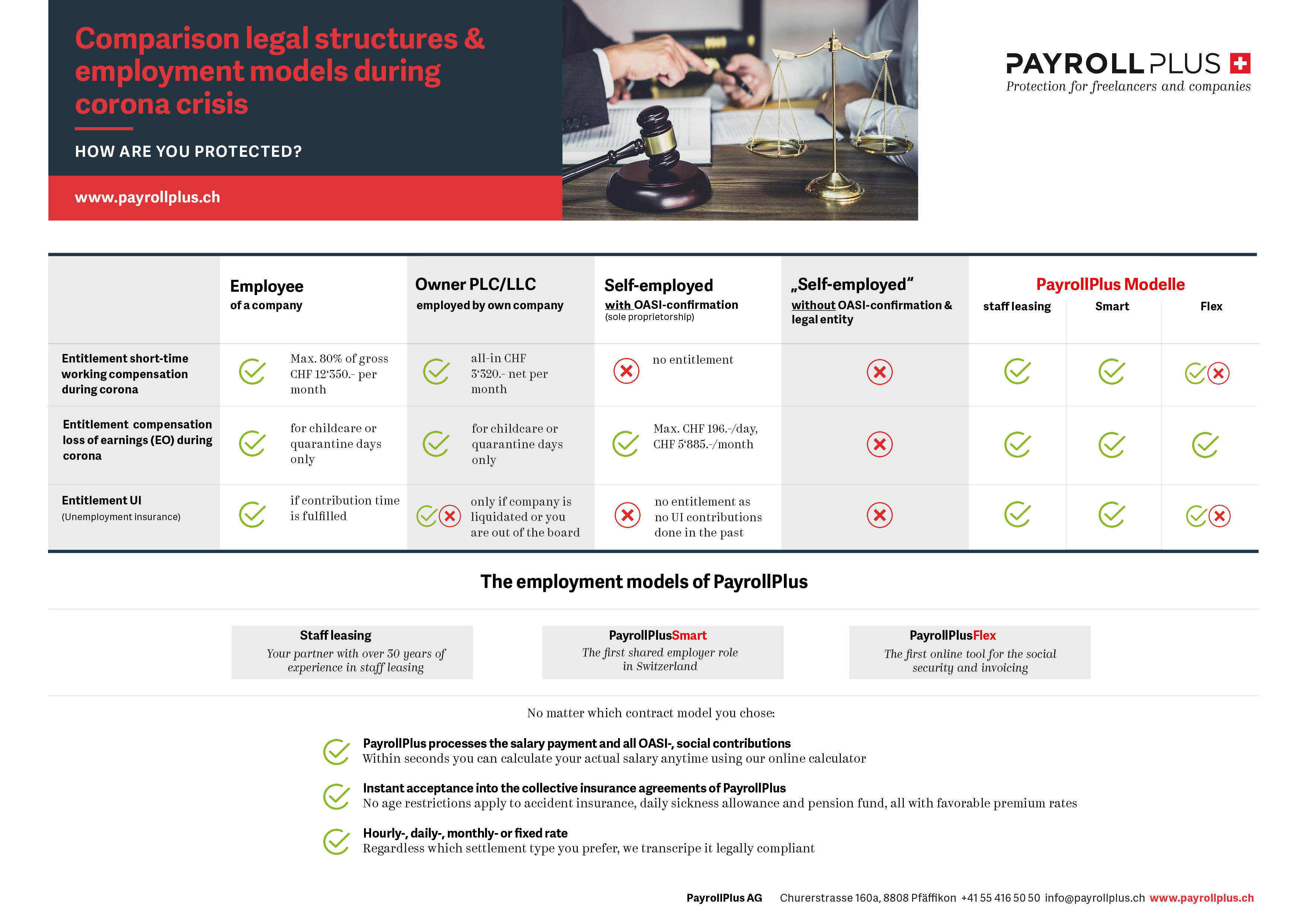

How am I protected for my salary during the corona crisis? A lot of people do ask that question since the government’s decision to close shops, restaurants, etc. We would like to provide a transparent overview with the above table list. What legal structure, employment model does offer what kind of social coverage?

The employed ones are protected the most in a crisis like corona compared to the other models.

The employment therefore is crisis proofed and broadly supported and protected by state.

The short-time work compensation can only be applied for a max. salary of CHF 12’350.- per month. Therefore, you would get CHF 9’880.- max (80% of 12’350.-).

Less protected within a crisis are the owners of a PLC or LLC. They are employees of their own company even if they had to pay the full unemployment insurance contributions in the past (UI 2.2%). At the beginning of the crisis the state did not grant them any short-time work entitlement. Later on, the state decided to grant an all-in amount per month of CHF 3’320.-. This guarantee is only temporary during the corona crisis, no one knows how the future entitlement in a further state crisis will look like.

In comparison, an employee receives max. CHF 9’880.- (80% of 12’350.- per month).

Completely different is the case for the sole-proprietors. A self-employed person who was accepted as such by the OASI, never has paid any unemployment insurance contribution in the past and therefore normally has not entitlement to government support and UI compensation. In succession of corona the state granted them the entitlement for a compensation of loss of earnings.

A lot of «self-employed» persons in Switzerland do not have a legal entity and are not properly registered with the authorities as self-employed. Therefore they do not contribute to the social institutions. It is irrelevant if they do that because a lack of knowledge, non-compliance or intention (illegal work).

These group of “self-employed” can not expect any governmental support in case of a crisis nor in case of accident, illness or disability.

The only thing left, the walk to the social welfare office and private insolvency.

In order to get a social protection in the future, they may use the employment models of PayrollPlus in the future. Invoicing through the unique online tool or a contract within staff leasing offers a broad range of protection. No matter which employment model is chosen, PayrollPlus takes care of the salary payment and they are on boarded to our collective insurance agreements.

Since 30 year we are concerned with questions about flex work, contract, work law, etc. and added two new and innovative employment models to our offering.

We provide valuable alternatives to the own company and self-employment including the long called social protection.

No matter which of the three employment model you choose, staff leasing, PayrollPlusSmart or PayrollPlusFlex:

For freelancers and corporates, which use the conventional staff leasing model for the external staff.

The degree of work and the salary needs to be guaranteed and it has to be adhered to the staff leasing law (AVG).

Der Personalverleih existiert seit 1989. Im Zusammenhang mit der Corona-Krise eröffnete der Bund vorübergehend ebenfalls für Temporäre- und Personalverleihfirmen die Möglichkeit, die Mitarbeitenden für Kurzarbeit anzumelden.

For SMEs, private household and Start-ups, which want to minimize their salary administration efforts and are looking for an easy all-in-one solution.

As the salary payments are transferred from our bank account, all the staff is automatically on-boarded (irrespective of its age) to our collective insurance agreements (daily sickness allowance, accident insurance, pension fund). On top PayrollPlus manages the OASI- declaration and all personnel administration needs.

You conclude the work contract directly with your staff. In a special agreement you instruct PayrollPlus with the management of the salary payments for your staff.

This employment model is crisis proofed. Employer and employee can count on normal compensation as given for employment.

PayrollPlusFlex

For freelancers, who work commission based and are looking for an easy solution to invoice their clients and for corporates, which do not want to take the risk of freelancers or contractors being false self-employed.

Die Rechnungsstellung erfolgt vom Freelancer über das Onlinetool von PayrollPlus. Unternehmen können die Rechnungen sorgenfrei begleichen, da PayrollPlus AG (juristische Person) der Rechnungssteller ist und somit nie die Gefahr besteht, dass das Unternehmen zum Arbeitgeber wird oder eine Scheinselbständigkeit vorliegt.

Due to his flexibility this employment model is only limited proofed in times of crisis.